Matchless Tips About Is It Risky To Do P2P

Is Engaging in P2P Lending a Risky Proposition?

1. Navigating the Peer-to-Peer Landscape

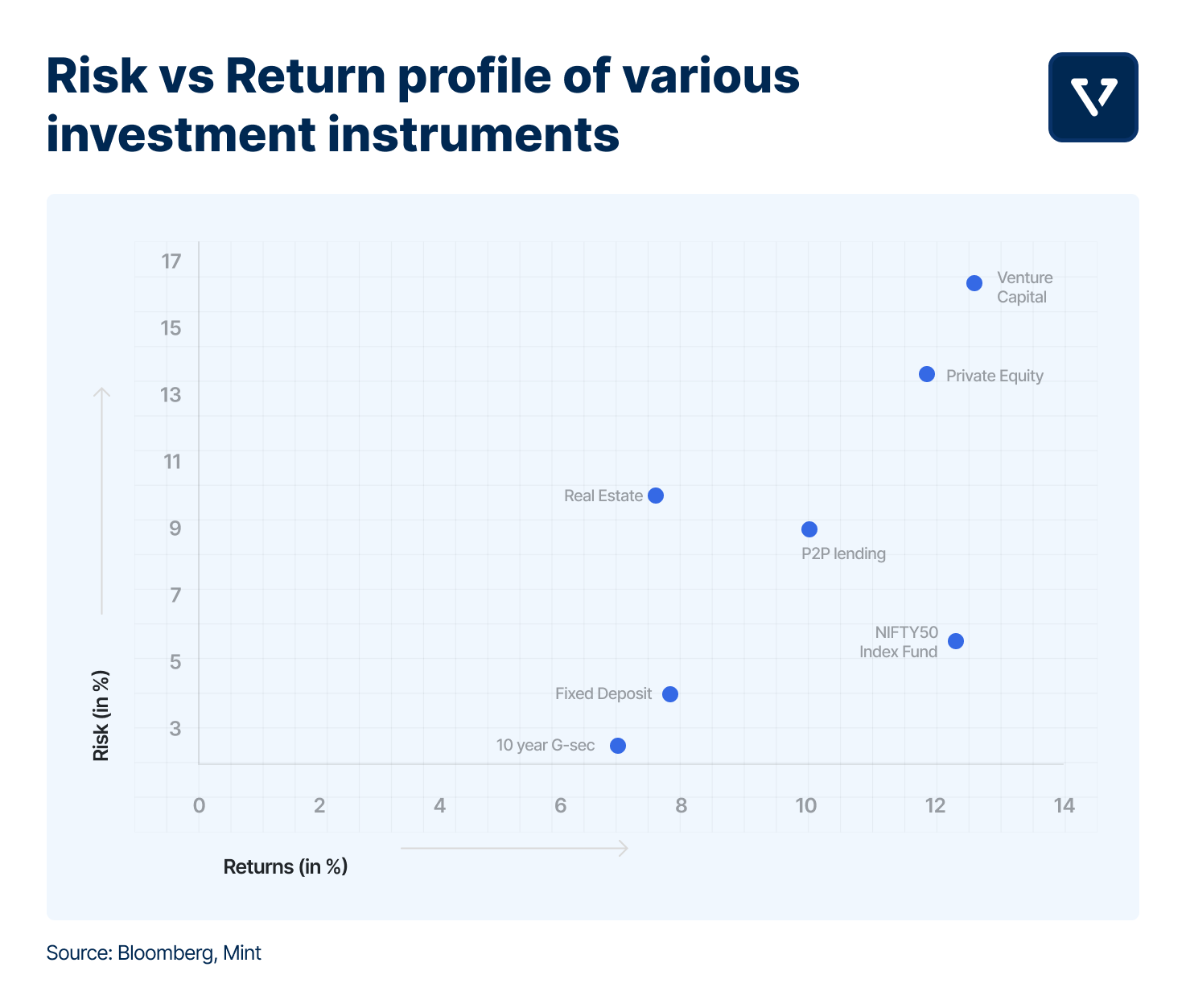

So, you're thinking about dipping your toes into the world of Peer-to-Peer (P2P) lending? It's understandable. The potential for higher returns than traditional savings accounts is definitely appealing. But before you jump in headfirst, let's unpack the question: Is it risky to do P2P? The short answer? Yes, like pretty much any investment, it carries its share of potential pitfalls.

Think of it like this: you're essentially becoming a bank, loaning money directly to individuals or businesses. Now, banks have entire departments dedicated to assessing risk and chasing down late payments. You? You're relying on the P2P platform's assessment and hoping for the best. That's not to say it's a complete gamble, but it's definitely worth understanding the potential downsides.

The core risk, of course, is default. Borrowers might not be able to repay their loans. When that happens, your investment takes a hit. P2P platforms often have mechanisms in place to mitigate this, like spreading your investment across multiple loans. However, even diversification doesn't eliminate the risk entirely. If the economy takes a nosedive, even borrowers with good credit histories can find themselves struggling.

Another aspect to consider is the platform itself. While many reputable P2P lending platforms exist, it's crucial to do your homework. Are they financially stable? What are their lending criteria? How transparent are they about their fees and processes? Choosing the wrong platform can significantly increase your risk. Remember, you're trusting them to manage your money and connect you with reliable borrowers.

Understanding the Types of Risks Involved

2. Diving Deeper into the Potential Downsides

Let's get a bit more specific about the kinds of risks you might encounter in the P2P world. Beyond the general risk of borrower default, several other factors can impact your investment. For starters, there's liquidity risk. Unlike a savings account, you can't always easily withdraw your money from P2P loans. Your funds are tied up for the duration of the loan term, which could be several years.

Then there's the risk of interest rate changes. If interest rates rise after you've invested in a P2P loan, you might miss out on higher returns elsewhere. While you're locked into the agreed-upon rate for your existing loan, new loans on the platform might offer more attractive terms. This can be a bit frustrating if you feel like you're leaving money on the table.

Platform risk, as mentioned earlier, is a significant concern. A platform could go bankrupt, change its policies, or even be subject to fraud. In such cases, recovering your investment can be difficult, if not impossible. Always thoroughly research the platform's history, management team, and security measures before entrusting them with your capital.

Lastly, consider regulatory risk. The P2P lending landscape is still relatively new, and regulations are constantly evolving. Changes in regulations could impact the profitability or even the legality of P2P lending in certain jurisdictions. Staying informed about the latest regulatory developments is crucial for managing your risk effectively.

IndiaP2P Review After 2 Months. Are 18 Returns Possible? P2P

Strategies for Mitigating P2P Lending Risks

3. Smart Moves to Protect Your Investments

Okay, so P2P lending comes with risks. That doesn't mean you should automatically dismiss it as an investment option. Instead, it means you need to be smart about how you approach it. Diversification is key. Don't put all your eggs in one basket (or, in this case, one loan). Spread your investment across multiple loans to different borrowers in various sectors. This reduces the impact if one borrower defaults.

Thoroughly vet the P2P platform before investing. Read reviews, check their financial stability, and understand their lending criteria. Look for platforms with a proven track record and transparent operations. Don't be afraid to ask questions and seek clarification on any aspects that are unclear.

Carefully assess the risk profile of each loan before investing. P2P platforms typically assign risk grades to borrowers, reflecting their creditworthiness. Higher-risk loans generally offer higher returns, but they also come with a greater chance of default. Choose loans that align with your risk tolerance and investment goals.

Keep a close eye on your investments. Monitor the performance of your loans and stay informed about any changes in the borrowers' circumstances. Be prepared to adjust your strategy if necessary. If you notice a borrower struggling to make payments, consider selling your loan on the secondary market (if available) to minimize your losses.

The Potential Rewards of P2P Lending

4. Weighing the Pros Against the Cons

Despite the risks, P2P lending can be a rewarding investment strategy. The potential for higher returns is a significant draw, especially in a low-interest-rate environment. P2P lending can offer returns that are significantly higher than those offered by traditional savings accounts or bonds.

It offers an opportunity to directly support businesses and individuals. Many borrowers turn to P2P lending because they can't access traditional bank loans. By investing in P2P loans, you're helping these borrowers achieve their goals, whether it's starting a business, consolidating debt, or funding a personal project. There's a certain satisfaction in knowing your money is making a tangible difference.

P2P lending platforms often provide detailed information about borrowers, allowing you to make informed investment decisions. You can see their credit scores, income levels, and loan purposes. This level of transparency can be empowering, giving you more control over where your money goes.

Finally, P2P lending can be a relatively passive investment. Once you've selected your loans, you don't need to actively manage them on a daily basis. You simply collect the interest payments and wait for the loans to be repaid. This can be a great option for those who want to diversify their portfolios without spending a lot of time and effort.

Risk In P2P Lending Explained Watch This Before Investing YouTube

Making an Informed Decision About P2P Lending

5. Is It Right for You?

Ultimately, the decision of whether or not to engage in P2P lending is a personal one. It depends on your risk tolerance, investment goals, and financial situation. If you're a conservative investor who prioritizes safety above all else, P2P lending might not be the right fit for you. However, if you're comfortable with taking on some risk in exchange for the potential for higher returns, it could be a valuable addition to your portfolio.

Before investing, take the time to thoroughly research the P2P lending landscape. Understand the different platforms, the types of loans they offer, and the risks involved. Don't invest more money than you can afford to lose. Start small and gradually increase your investment as you gain more experience.

Remember that P2P lending is not a "get rich quick" scheme. It requires patience, discipline, and a willingness to learn. Be prepared for the possibility of defaults and don't panic if some of your loans go sour. The key is to manage your risk effectively and stay informed about the market.

Consider consulting with a financial advisor before making any significant investment decisions. A qualified advisor can help you assess your risk tolerance, develop a personalized investment strategy, and choose the right P2P lending platform for your needs. They can also provide ongoing support and guidance as you navigate the world of P2P lending.

Discussion Of The Risks And Risk Control P2P In China

FAQ

6. Your Burning Questions Answered

Still have some questions swirling around? Let's tackle some common concerns about P2P lending:

Q: What happens if a borrower defaults on their loan?

7. Default Scenarios Explained

A: If a borrower defaults, the P2P platform will typically attempt to recover the funds through collection agencies or legal action. However, there's no guarantee that you'll recover the full amount of your investment. Some platforms have "provision funds" to cover losses from defaults, but these funds may not be sufficient to cover all losses. This is why diversification is so important.

Q: How is P2P lending regulated?

8. Understanding the Regulatory Framework

A: The regulation of P2P lending varies depending on the jurisdiction. In some countries, P2P lending platforms are subject to strict regulations, while in others, the regulatory framework is less well-defined. It's important to understand the regulatory environment in your country before investing in P2P loans. Check with your local financial regulatory body for the most up-to-date information.

Q: Is P2P lending suitable for retirement savings?

9. P2P and Retirement Planning

A: P2P lending can be a component of a diversified retirement portfolio, but it's generally not recommended as the sole or primary investment. Due to the inherent risks, it's best to allocate only a small portion of your retirement savings to P2P loans. Consider consulting with a financial advisor to determine the appropriate allocation based on your risk tolerance and retirement goals. Remember, a diversified portfolio across various asset classes is typically the safest approach for retirement planning.